Wuhan Coronavirus Outbreak Affects Upholstery and Decorative Fabric Supply Chain, Along With Sales

Hit to Global Economy Worse Than SARS

February 7, 2020

MIAMI BEACH, Fla. --Major airlines and auto manufacturers have suspended activities in China due to the rapid growth of the coronavirus in that country.

The epidemic could also interrupt supply lines for other industries, including the fabric industry and the ancillary producers of fibers, yarns, and dye houses.

This is the finding of a Fabrics & Furnishings International inquiry into the growing threat of the coronavirus to the world textile trade.

Mill owner David Li says he's confident the coronavirus will be under control in a few weeks in China.

“The major challenge from the coronavirus problem is the uncertainty it creates on the supply chain,” says David Li, owner of an upholstery mill and a bedding company in China and also an exporter to the U.S. “As ex-Soviet Union, the first reaction a communist regime tends to take in front of a disaster is try to cover. Sadly, China is no exception.”

“China lost a few weeks to alert the public. Now the problem is getting out of control in Wuhan and Hubei province. It is heartbreaking and very upsetting to see so many innocent people getting sick, even losing their lives, because of the lack of transparency. It shows how fragile life can be and how important freedom and transparency are.”

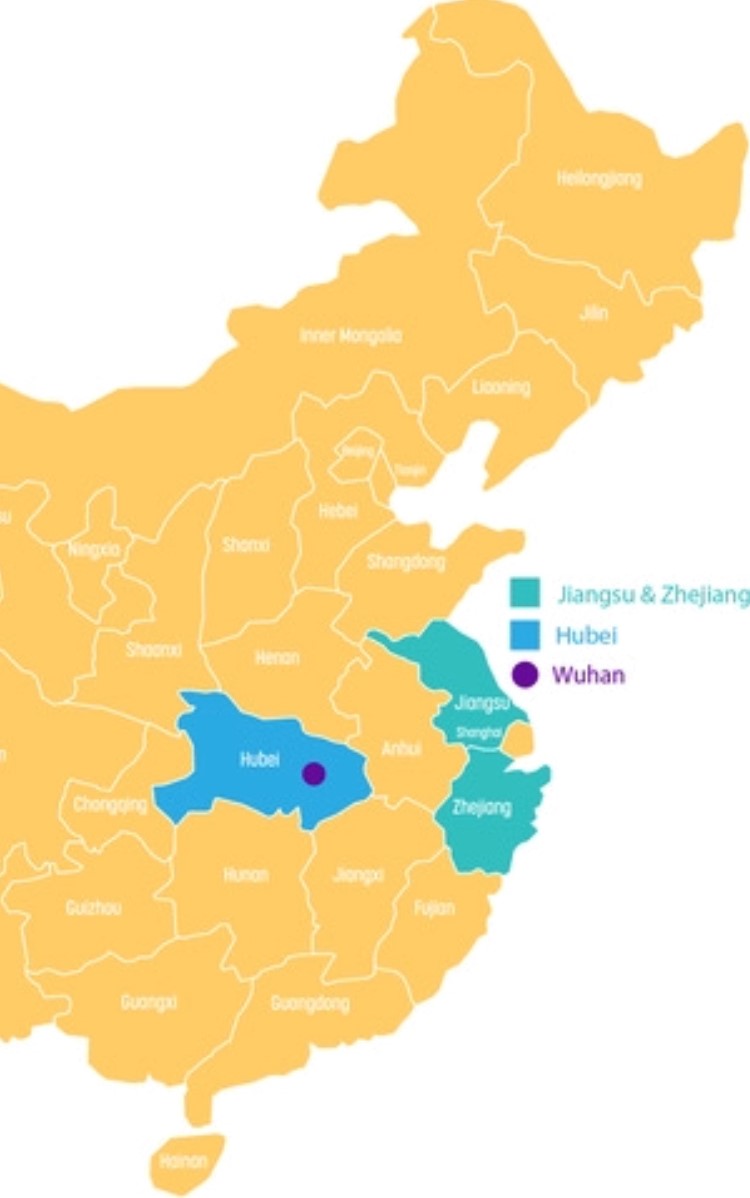

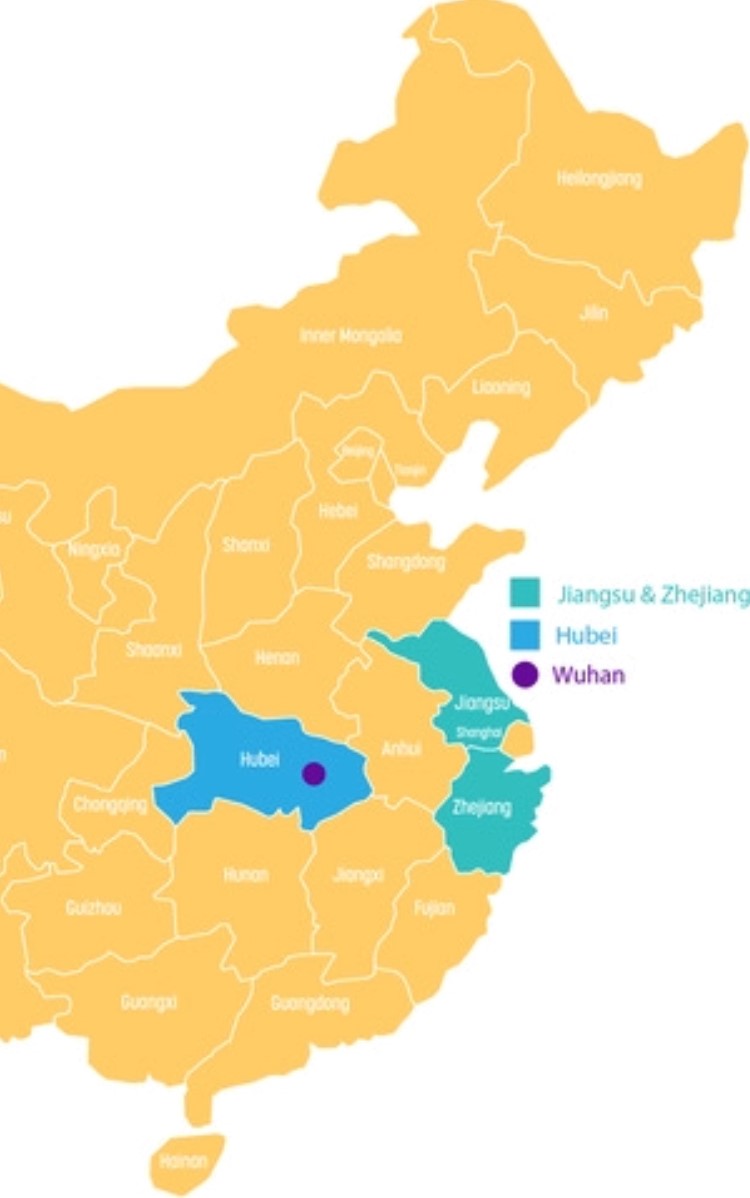

Wuhan, where the coronavirus originated, is about 620 miles from China's major fabric mills.

The virus outbreak in Wuhan is some 620 miles from major fabric manufacturers, which could reopen in February.

“Regarding the impact to the fabric industry, if you look at the China map, you will notice that Wuhan and Hubei Province is in the middle of China, while the Chinese upholstery fabric industry is mostly located in coastal Zhejiang and Jiangsu provinces,” Li says. “Zhejiang and Jiangsu are about 1,000 kilometers [621 miles] away from Wuhan and Hubei. Their geographic relationship is similar to that of France /Germany (in relation) to Hungary. China has now applied very tight control on the human movements. Factories were told not to reopen until February 9. I am confident that Coronavirus will be under control in a few weeks. They stopped SARS in 2003. They can stop Corona in 2020.”

It’s uncertain if lead-times will be enough to handle shipments to the U.S.

“So far as we are concerned, we deal with mostly major US retailers and manufacturers,” Li says. “We are always prepared for a 12-14 week lead-time. We have enough yarn and fabric stock for our programs. We will struggle a little as we lose almost over a week of weaving and printing time, but we will be fine.”

One U.S.-based Chinese fabric importer who preferred not to be quoted by name, says he, “really doesn’t have clear answers as the world economy is so intertwined. While we import little directly from China, there are so many components and distribution links that may be disrupted.”

He continues: “Unexpected impacts are rather likely when the smooth flow of markets is unexpectedly altered. Yarn and dye supplies may be affected by weavers and printers in Europe and America. Logistics may change. Costs of raw materials and consumer sourcing preferences may change. Unpredictability in business is a negative. How negative is hard to tell. Thus far, I have seen no impact.”

Chinese Domestic Market Already Affected

“This coronavirus, which started in Wuhan in the Hubei Province, has a very big impact on the fabric business for the domestic Chinese market,” says Hohans Cheung, owner of Morprow, a major importer of Chinese fabrics into Europe and a domestic player in China.

Hohans Cheung, the owner of Morprow, says the Chinese New Year coinciding with the virus outbreak means a faster recovery.

“This coronavirus, which initially only influenced a province (although an important province), has become a nationwide problem. The shops are closed and the streets are empty. In addition, it also impacts the complete distribution,” Cheung says. “Customers cannot rely on their deliveries being on time or even getting delivered. Normally the Chinese New Year already is a period that sales go down, but now this period is getting longer, and it takes additional time to get the sales back up. What will also happen is that market sentiment is becoming really unstable. Customers are even more cautious, and this will result in lower pick-ups for the new collections. Projects are canceled or are put on hold because of this instability.”

Cheung points out that while there is uncertainty, he is optimistic the textile manufacturing will return around March.

“Priorities are shifting from consumers and this will also result in lower spending in the fabric business,” he says. “The number of cases of the coronavirus is relatively low and the fatality rate is also low at 2%-3% (although one is one too many), the emotion of the people and the market is the biggest influence. So overall this will have a negative influence on the whole domestic Chinese market. At the moment, I expect that the market will not recover very quickly and according to the experts, we can expect only in the middle of March that we can slowly start working to recovery again.”

Chinese officials are taking measures to contain the virus.

“This time we see, although in a slightly delayed reaction, that China is determined to get this coronavirus fixed and contained,” Cheung says. “Severe measures and regulations were taken by China: Nationwide curfews, transportation controls, and containment procedures are quite drastic, but will be effective. Also, the willingness to invest like building a complete temporary hospital in a mere ten days with capacity for over a thousand patients are just some of these measures. People are buying premium face masks, disinfectants, and gloves instead of cheap ones. This is a change of mentality in the market that was already happening before the virus.”

Cheung predicts once the virus is contained, the domestic textile market will shift.

“In the long term though we will see new opportunities after this virus; it causes the market to have more faith in the stability caused by the government,” he says. “Also, the people will be willing to spend more to better their lifestyle instead of keeping it in savings. This will result in a shift from lower to a more mid- to high-end market.”

“For the export business, I think we will have some very big challenges to take on,” Cheung says. “During early February, the factories were still closed and the expectations for opening were around February 21. This will extend the already difficult time for production to follow up on after the Chinese New Year.”

He says although a lot of factory workers are not located in the Wuhan area and come from other regions in China, this will still result in big delays for workers to return. Late openings and the shortages of workers in the factories will result in delays in productions and delays in deliveries to customers.

“The biggest challenge for the export business will be the emotion of the market,” Cheung says. “If the market does not recover as speedily as we hope, the long-term effects will be a very unstable market for a long time. Less confident and smaller factories will feel the biggest impact of this, so every supplier will have to improve themselves by being even better and more consistent in this already difficult market. I think in the end the ‘good’ ones will survive: the complete export market becomes smaller and less players with bigger market share for export will result.”

U.S. companies continue to monitor the situation.

Greg Tarver, president of Covington Fabrics & Design, has had minor issues as a result of the coronavirus outbreak.

“So far, we have had a few Chinese suppliers indicate that their post-coronavirus production resumption will be delayed but these are minor,” says Greg Tarver, president of Covington Fabrics & Design in New York. “We've answered a few customer's specific questions on a SKU-level basis when they've had concerns. Our logistics team continues to get updates.”

Phil Levy, the chief economist for Flexport, says the economic impact of coronavirus could be worse than the 2003 SARS virus.

Phil Levy, the chief economist for Flexport, a freight forwarder based in San Francisco, says air shipment costs will likely increase.

“First and foremost, we’re focused on keeping our employees in China and around the world safe,” Levy says. “We’re also watching for impacts on the supply chain as the virus causes more and more business interruptions.

“We’ve already seen a steady stream of major airlines canceling flights to and from China. In some cases, the cancellations are comprehensive. Others have focused on specific routes. Most of the reductions are until the end of March—well beyond the Chinese New Year holiday.”

Levy says much will depend on when Chinese travel restrictions are lifted, and factories resume production.

“How will all this affect the global economy?” Levy asks. “The full impact will depend, in great part, on how long business interruptions last. Because we expected a supply chain lull during the Chinese New Year period anyway, most shipments had already been pushed through before then.

“Now that the holiday has been extended, an important question is how much of post-Chinese New Year freight will ultimately be impacted.”

There are many variables to how freight shipments could be affected.

“Unlike air freight, ocean freight is usually pretty independent of passenger traffic and accounts for the bulk of supply chain shipments,” Levy says. “But the Yangtze is a very important internal waterway running through Wuhan. When traffic is disrupted, the effect can be significant.”

Coronavirus’ Economic Impact Could be Compared to SARS Outbreak

Severe acute respiratory syndrome (SARS) appeared in China in 2002, and spread worldwide within a few months, but was quickly contained. No known transmission has occurred since 2004.

“While we do not yet know how this coronavirus outbreak will play out—and we obviously hope it will be very limited— one estimate of the immediate economic impact of the 2003 SARS outbreak was a cut to Chinese GDP (gross domestic product) of just over 1% and a hit to Hong Kong GDP of over 2.5%,” Levy says.

He adds Taiwan was estimated to have lost just under 0.5% of GDP, and the authors of the study found longer-term drags (over 10 years) of 2.3% of GDP for China, 3.2% for Hong Kong, and just over 0.5% for Taiwan.

“Those are significant, though not enormous numbers, over a longer-term,” Levy says. “But such a reaction to the new coronavirus would come on top of slow-downs we have already seen in China and Hong Kong. Meanwhile, China has already reported more cases of the new virus than it had of SARS.”

The epidemic could also interrupt supply lines for other industries, including the fabric industry and the ancillary producers of fibers, yarns, and dye houses.

This is the finding of a Fabrics & Furnishings International inquiry into the growing threat of the coronavirus to the world textile trade.

Mill owner David Li says he's confident the coronavirus will be under control in a few weeks in China.

“The major challenge from the coronavirus problem is the uncertainty it creates on the supply chain,” says David Li, owner of an upholstery mill and a bedding company in China and also an exporter to the U.S. “As ex-Soviet Union, the first reaction a communist regime tends to take in front of a disaster is try to cover. Sadly, China is no exception.”

“China lost a few weeks to alert the public. Now the problem is getting out of control in Wuhan and Hubei province. It is heartbreaking and very upsetting to see so many innocent people getting sick, even losing their lives, because of the lack of transparency. It shows how fragile life can be and how important freedom and transparency are.”

Wuhan, where the coronavirus originated, is about 620 miles from China's major fabric mills.

The virus outbreak in Wuhan is some 620 miles from major fabric manufacturers, which could reopen in February.

“Regarding the impact to the fabric industry, if you look at the China map, you will notice that Wuhan and Hubei Province is in the middle of China, while the Chinese upholstery fabric industry is mostly located in coastal Zhejiang and Jiangsu provinces,” Li says. “Zhejiang and Jiangsu are about 1,000 kilometers [621 miles] away from Wuhan and Hubei. Their geographic relationship is similar to that of France /Germany (in relation) to Hungary. China has now applied very tight control on the human movements. Factories were told not to reopen until February 9. I am confident that Coronavirus will be under control in a few weeks. They stopped SARS in 2003. They can stop Corona in 2020.”

It’s uncertain if lead-times will be enough to handle shipments to the U.S.

“So far as we are concerned, we deal with mostly major US retailers and manufacturers,” Li says. “We are always prepared for a 12-14 week lead-time. We have enough yarn and fabric stock for our programs. We will struggle a little as we lose almost over a week of weaving and printing time, but we will be fine.”

One U.S.-based Chinese fabric importer who preferred not to be quoted by name, says he, “really doesn’t have clear answers as the world economy is so intertwined. While we import little directly from China, there are so many components and distribution links that may be disrupted.”

He continues: “Unexpected impacts are rather likely when the smooth flow of markets is unexpectedly altered. Yarn and dye supplies may be affected by weavers and printers in Europe and America. Logistics may change. Costs of raw materials and consumer sourcing preferences may change. Unpredictability in business is a negative. How negative is hard to tell. Thus far, I have seen no impact.”

Chinese Domestic Market Already Affected

“This coronavirus, which started in Wuhan in the Hubei Province, has a very big impact on the fabric business for the domestic Chinese market,” says Hohans Cheung, owner of Morprow, a major importer of Chinese fabrics into Europe and a domestic player in China.

Hohans Cheung, the owner of Morprow, says the Chinese New Year coinciding with the virus outbreak means a faster recovery.

“This coronavirus, which initially only influenced a province (although an important province), has become a nationwide problem. The shops are closed and the streets are empty. In addition, it also impacts the complete distribution,” Cheung says. “Customers cannot rely on their deliveries being on time or even getting delivered. Normally the Chinese New Year already is a period that sales go down, but now this period is getting longer, and it takes additional time to get the sales back up. What will also happen is that market sentiment is becoming really unstable. Customers are even more cautious, and this will result in lower pick-ups for the new collections. Projects are canceled or are put on hold because of this instability.”

Cheung points out that while there is uncertainty, he is optimistic the textile manufacturing will return around March.

“Priorities are shifting from consumers and this will also result in lower spending in the fabric business,” he says. “The number of cases of the coronavirus is relatively low and the fatality rate is also low at 2%-3% (although one is one too many), the emotion of the people and the market is the biggest influence. So overall this will have a negative influence on the whole domestic Chinese market. At the moment, I expect that the market will not recover very quickly and according to the experts, we can expect only in the middle of March that we can slowly start working to recovery again.”

Chinese officials are taking measures to contain the virus.

“This time we see, although in a slightly delayed reaction, that China is determined to get this coronavirus fixed and contained,” Cheung says. “Severe measures and regulations were taken by China: Nationwide curfews, transportation controls, and containment procedures are quite drastic, but will be effective. Also, the willingness to invest like building a complete temporary hospital in a mere ten days with capacity for over a thousand patients are just some of these measures. People are buying premium face masks, disinfectants, and gloves instead of cheap ones. This is a change of mentality in the market that was already happening before the virus.”

Cheung predicts once the virus is contained, the domestic textile market will shift.

“In the long term though we will see new opportunities after this virus; it causes the market to have more faith in the stability caused by the government,” he says. “Also, the people will be willing to spend more to better their lifestyle instead of keeping it in savings. This will result in a shift from lower to a more mid- to high-end market.”

“For the export business, I think we will have some very big challenges to take on,” Cheung says. “During early February, the factories were still closed and the expectations for opening were around February 21. This will extend the already difficult time for production to follow up on after the Chinese New Year.”

He says although a lot of factory workers are not located in the Wuhan area and come from other regions in China, this will still result in big delays for workers to return. Late openings and the shortages of workers in the factories will result in delays in productions and delays in deliveries to customers.

“The biggest challenge for the export business will be the emotion of the market,” Cheung says. “If the market does not recover as speedily as we hope, the long-term effects will be a very unstable market for a long time. Less confident and smaller factories will feel the biggest impact of this, so every supplier will have to improve themselves by being even better and more consistent in this already difficult market. I think in the end the ‘good’ ones will survive: the complete export market becomes smaller and less players with bigger market share for export will result.”

U.S. companies continue to monitor the situation.

Greg Tarver, president of Covington Fabrics & Design, has had minor issues as a result of the coronavirus outbreak.

“So far, we have had a few Chinese suppliers indicate that their post-coronavirus production resumption will be delayed but these are minor,” says Greg Tarver, president of Covington Fabrics & Design in New York. “We've answered a few customer's specific questions on a SKU-level basis when they've had concerns. Our logistics team continues to get updates.”

Phil Levy, the chief economist for Flexport, says the economic impact of coronavirus could be worse than the 2003 SARS virus.

Phil Levy, the chief economist for Flexport, a freight forwarder based in San Francisco, says air shipment costs will likely increase.

“First and foremost, we’re focused on keeping our employees in China and around the world safe,” Levy says. “We’re also watching for impacts on the supply chain as the virus causes more and more business interruptions.

“We’ve already seen a steady stream of major airlines canceling flights to and from China. In some cases, the cancellations are comprehensive. Others have focused on specific routes. Most of the reductions are until the end of March—well beyond the Chinese New Year holiday.”

Levy says much will depend on when Chinese travel restrictions are lifted, and factories resume production.

“How will all this affect the global economy?” Levy asks. “The full impact will depend, in great part, on how long business interruptions last. Because we expected a supply chain lull during the Chinese New Year period anyway, most shipments had already been pushed through before then.

“Now that the holiday has been extended, an important question is how much of post-Chinese New Year freight will ultimately be impacted.”

There are many variables to how freight shipments could be affected.

“Unlike air freight, ocean freight is usually pretty independent of passenger traffic and accounts for the bulk of supply chain shipments,” Levy says. “But the Yangtze is a very important internal waterway running through Wuhan. When traffic is disrupted, the effect can be significant.”

Coronavirus’ Economic Impact Could be Compared to SARS Outbreak

Severe acute respiratory syndrome (SARS) appeared in China in 2002, and spread worldwide within a few months, but was quickly contained. No known transmission has occurred since 2004.

“While we do not yet know how this coronavirus outbreak will play out—and we obviously hope it will be very limited— one estimate of the immediate economic impact of the 2003 SARS outbreak was a cut to Chinese GDP (gross domestic product) of just over 1% and a hit to Hong Kong GDP of over 2.5%,” Levy says.

He adds Taiwan was estimated to have lost just under 0.5% of GDP, and the authors of the study found longer-term drags (over 10 years) of 2.3% of GDP for China, 3.2% for Hong Kong, and just over 0.5% for Taiwan.

“Those are significant, though not enormous numbers, over a longer-term,” Levy says. “But such a reaction to the new coronavirus would come on top of slow-downs we have already seen in China and Hong Kong. Meanwhile, China has already reported more cases of the new virus than it had of SARS.”