US Suspends Some Chinese Textile Tariffs

Concerns About Holiday Shopping Season

August 14, 2019

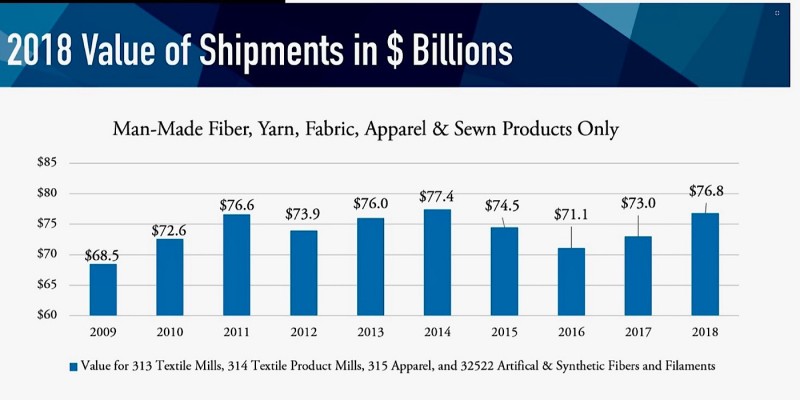

The value of several U.S. textile exports increased 12% in the last decade, totaling $76 billion in 2018. Source: NCTO.org.

WASHINGTON -- The Trump administration suspended its additional 10% tariff to take effect Sept. 1, which will now hit on Dec. 15, on about $200 billion in goods from China.

Now, there is a 25% tariff on some Chinese imports, including textiles.

Textile items that are on the tariff list include, according to the TRSA [it does not have an acronym], which represents U.S. companies that supply, launder, and maintain linens and uniforms.

Here are other major categories included in the 25% tariff.

Not all Chinese textiles will be exempt until December.

Tariffs on some $13.7 billion of fabrics and apparel are postponed until Dec. 15, but the 10% tariff will be added to about $39 billion on some fabrics and apparel, according to the Wall Street Journal. It was not immediately known which fabrics will be included with the additional tariff.

U.S. TEXTILE INDUSTRY REACTS

The National Council of Textile Organizations (NCTO) praised in a release suspending the additional 10% tariff, but on the other hand, it stressed its continuing objection to tariffs at all. The Washington-based NCTO association represents the spectrum of the U.S. textile industry, from fibers to finished products.

“We have long argued that adding tariffs on imports of manufacturing inputs that are not made in the U.S. in effect raises the cost for American companies,” NCTO President and CEO Kim Glas says in an Aug. 13 release.

Michael Saivetz, Richloom Fabrics Group COO, agrees and points out that not only raw materials, but also finished Chinese products, such as a couch, for example, should also have tariffs but are not.

“The increase is going to be passed on to the U.S. consumer,” Saivetz said in an interview last year, shortly after testifying in Washington. “[The tariffs are] making it less competitive for American manufacturers.”

Richloom Contract is ranked 11th with $35 million in annual sales in the F&FI World’s Top 40 Contract Fabric Specialists, included in the Autumn 2019 issue.

NCTO officials testified on June 20, urging the Trump administration to also include tariffs on finished apparel and home textile products.

“U.S. manufacturers … have suffered enormously from China’s illegal IPR [intellectual property rights] activities and state-sponsored export subsidies,” Glas says in a statement.

Also, NCTO wants the administration to “include de minimis shipments below $800 on the retaliatory list.”

“The provision creates a significant loophole at a time when the administration is seeking to address China’s unfair trade practices,” Glas says in a statement.

Fast Facts: U.S. 2018 Textile Industry

Now, there is a 25% tariff on some Chinese imports, including textiles.

Textile items that are on the tariff list include, according to the TRSA [it does not have an acronym], which represents U.S. companies that supply, launder, and maintain linens and uniforms.

- Man-made textiles: polyester, polyp propylene, rayon, and nylon.

- Corduroy, gauze, lace, badges, embroidery and terrycloth-towel fabric.

- Cotton: fibers, thread, yarn, and denim.

- Silk.

Here are other major categories included in the 25% tariff.

- Plastics: vinyl flooring and other plastic floor and wall coverings

- Raw hides and leather.

- Furniture, bedding, and mattresses: car seats; wood chairs; furniture designed for offices, kitchen and more; mattresses; lamps.

Not all Chinese textiles will be exempt until December.

Tariffs on some $13.7 billion of fabrics and apparel are postponed until Dec. 15, but the 10% tariff will be added to about $39 billion on some fabrics and apparel, according to the Wall Street Journal. It was not immediately known which fabrics will be included with the additional tariff.

U.S. TEXTILE INDUSTRY REACTS

The National Council of Textile Organizations (NCTO) praised in a release suspending the additional 10% tariff, but on the other hand, it stressed its continuing objection to tariffs at all. The Washington-based NCTO association represents the spectrum of the U.S. textile industry, from fibers to finished products.

“We have long argued that adding tariffs on imports of manufacturing inputs that are not made in the U.S. in effect raises the cost for American companies,” NCTO President and CEO Kim Glas says in an Aug. 13 release.

Michael Saivetz, Richloom Fabrics Group COO, agrees and points out that not only raw materials, but also finished Chinese products, such as a couch, for example, should also have tariffs but are not.

“The increase is going to be passed on to the U.S. consumer,” Saivetz said in an interview last year, shortly after testifying in Washington. “[The tariffs are] making it less competitive for American manufacturers.”

Richloom Contract is ranked 11th with $35 million in annual sales in the F&FI World’s Top 40 Contract Fabric Specialists, included in the Autumn 2019 issue.

NCTO officials testified on June 20, urging the Trump administration to also include tariffs on finished apparel and home textile products.

“U.S. manufacturers … have suffered enormously from China’s illegal IPR [intellectual property rights] activities and state-sponsored export subsidies,” Glas says in a statement.

Also, NCTO wants the administration to “include de minimis shipments below $800 on the retaliatory list.”

“The provision creates a significant loophole at a time when the administration is seeking to address China’s unfair trade practices,” Glas says in a statement.

Fast Facts: U.S. 2018 Textile Industry

- The U.S. textile industry supply chain—from textile fibers to apparel and other sewn products—employed 594,147 workers in 2018. The U.S. government estimates that one textile manufacturing job in this country supports three other jobs.

- U.S. textile and apparel shipments totaled $76.8 billion in 2018.

- The U.S. industry is the second-largest exporter of textile-related products in the world. Fiber, textile, and apparel exports combined were $30.1 billion in 2018.

- Excluding raw cotton and wool, half of U.S. textile supply chain exports went to our Western Hemisphere free trade partners in 2018. The entire U.S. textile supply chain exported to more than 200 countries, with 27 countries importing $100 million or more.

- The U.S. textile industry supplies more than 8,000 different textile products to the U.S. military.

- The U.S. is the world leader in textile research and development, developing next-generation-textile materials, such as conductive fabric with antistatic properties, electronic textiles that can monitor heart rate and other vital signs, antimicrobial fibers, lifesaving body armor, and new fabrics that adapt to the climate to make the wearer warmer or cooler.

- The U.S. textile industry invested $22.8 billion in new plants and equipment from 2006 to 2017. Recently, U.S. manufacturers have opened new facilities throughout the textile production chain, including recycling facilities to convert textile and other waste to new textile uses and resins.

- U.S. textile mills have increased labor productivity by 60% since 2000.

- In 2017, hourly and nonsupervisory textile mill workers on average earned 136% more than clothing store workers ($646 per week vs. $274) and received health care and pension benefits.